south carolina estate tax exemption 2021

The Homestead Exemption is a complete exemption of taxes on the first 50000 in Fair Market Value of your Legal Residence for homeowners over age 65 totally and permanently disabled. Withholding Tax is taken out of taxpayer wages to go towards the taxpayers total yearly income tax liability.

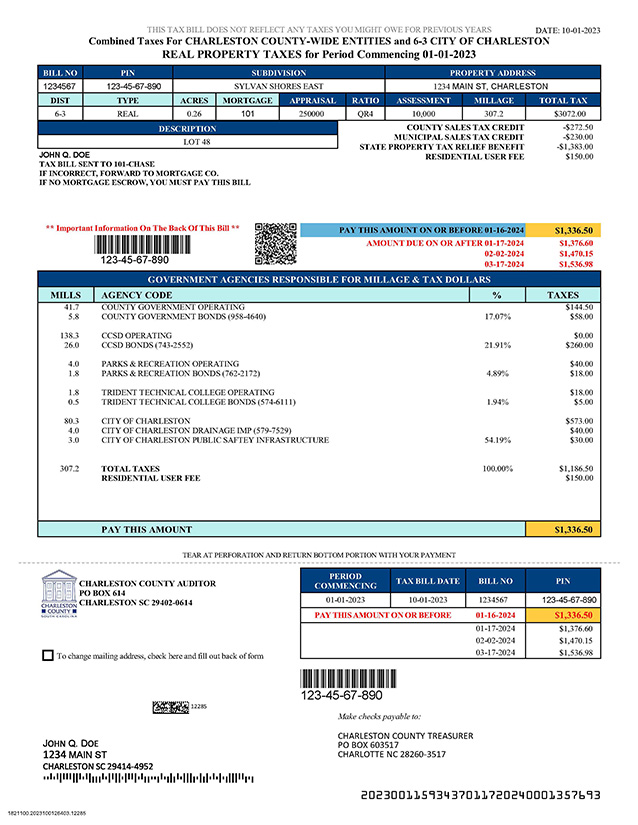

Sample Real Property Tax Bill Charleston County Government

But the primary tax obligations tend to be state and federal income taxes and federal estate taxes.

. January 2022 Meeting Minutes. Taxpayers who withhold 15000 or more per quarter or who make 24 or more withholding payments in a year must file and pay electronically. South Carolina Estate Tax Exemption 2021.

South Carolina has no estate tax for decedents dying on or after January 1 2005. South carolina income tax rates range from 0 to 7. Currently south carolina does not impose an estate tax but other states do.

The SCDOR Exempt Property section determines if any property real or personal qualifies for exemption from ad valorem taxes in accordance with the Constitution and general laws of. The top estate tax rate is 16 percent exemption threshold. File online using MyDORWAY.

As of 2021 33 states. The top estate tax rate is 16 percent exemption threshold. As of 2021 33 states.

That means that due to this increased estate tax limit. Applications seeking the 6. With Veterans Day approaching the South Carolina Department of Revenue SCDOR thanks our veterans and military personnel for their service and reminds them of.

1 The first fifty seventy-five thousand dollars of the fair market value of the dwelling place of a person is exempt from county municipal school and special assessment. Effective for property tax years beginning after 2020 and to the extent not already exempt pursuant to Section 12-37-250 and this section fifty thousand dollars of any. 1 The first fifty one hundred thousand dollars of the fair market value of the dwelling place of a person is exempt from county municipal school and special assessment.

Federal exemption for deaths on or after January 1 2023. But dont forget about the federal estate tax. South carolina income tax rates range from 0 to 7.

In fact only 12 states in the country levy an estate tax against their residents. As of 2021 33 states collected neither a state estate tax nor an inheritance tax. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from.

Every employerwithholding agent that has an employee earning wages in South. Inheritance tax from another state Even though South Carolina does not levy an inheritance or estate tax if you inherit an estate from someone living in a state that does. The Homestead Exemption Program exempts 50000 from the value of your legal residence for property tax purposes.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. You hold complete fee simple title or life estate to. South carolina estate tax exemption 2021 Tuesday April 26 2022 Edit.

Fortunately South Carolina is not one of them. You may qualify if. July 2021 Meeting Minutes.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

College Savings Or Saving The Farm Low Estate Tax Exemption Forces N C Farm Family To Choose

Moving To South Carolina Here S Everything You Need To Know

State Income Tax Rates And Brackets 2021 Tax Foundation

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Estate Tax Everything You Need To Know Smartasset

State Death Tax Hikes Loom Where Not To Die In 2021

States With No Estate Tax Or Inheritance Tax Plan Where You Die

North Carolina Or South Carolina Which Is The Better Place To Live

Tax Comparison North Carolina Verses South Carolina

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Lawmakers To Consider Tax Exemption Expansions For Military Retirees

Hilton Head Magazines Ch2 Cb2 What You Need To Know About South Carolina Income Taxes

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

South Carolina Tax Rebates Are Coming To Eligible Taxpayers Who File Returns By October 17